Technology and finance seem distinct but share a profound commonality: both thrive on precision, adaptability, and innovation. As someone rooted in software engineering, I’ve always been intrigued by how my technical skills could break boundaries. Recently, this curiosity led me to explore the fascinating domain of Expert Advisor (EA) development—a field where code transforms into financial opportunity. While I’m still in the early stages of learning, the potential I’ve uncovered is too exciting not to share.

The Allure of Financial Automation

Think about it: Algorithms make trades while you sleep, free from the emotional turbulence that plagues manual trading. This is the promise of financial automation. Forex trading, a 24-hour global marketplace, is an ideal playground for such innovations. By leveraging platforms like MetaTrader 4 and 5, Expert Advisors execute trades based on pre-defined logic, responding to market changes faster than any human could.

For software engineers, this is more than an intellectual exercise. It’s an opportunity to blend logic with strategy, building systems that don’t just function—they thrive in unpredictable environments. Financial automation, in essence, is where technology meets trust.

How Software Engineering Skills Transfer to EA Development

At first glance, the world of forex trading might seem far removed from software engineering. However, many of the core skills you already possess as an engineer directly align with the demands of EA development. Here’s how:

- Programming Mastery: As a software engineer, you’re no stranger to writing efficient, modular, and reusable code. The scripting languages for EA development, like MQL4 and MQL5, are straightforward extensions of familiar programming paradigms, making the transition seamless.

- Algorithmic Thinking: EA development thrives on algorithms that define trading rules, manage risks, and trigger actions. Your expertise in crafting problem-solving and system optimization algorithms perfectly equips you to design these logic-driven trading systems.

- Data Analysis Skills: Whether parsing logs or visualizing complex datasets, your ability to analyze data translates directly to interpreting forex market trends and patterns. This skill is crucial for creating strategies that are both responsive and effective.

- Automation Expertise: Software engineering is renowned for automating repetitive tasks. EA development elevates this skill by automating trading decisions to reduce human error and capitalize on market opportunities in real-time.

- Debugging and Testing: The rigorous debugging and testing methodologies you’ve honed are invaluable when backtesting and forwardtesting EAs. Testing strategies against historical data and iterating on outcomes mirrors debugging in software development.

These skills create a strong foundation, making EA development an exciting and achievable pivot for software engineers eager to innovate.

My Early Steps in Expert Advisor Development

Starting on the journey of EA development has been both challenging and rewarding. Over the past month, I’ve taken deliberate steps to build a foundation in this exciting field. Here’s a more detailed look at how I’ve approached it:

- Understanding Forex Basics: Before diving into automation, I spent time learning the fundamentals of forex trading. This included understanding currency pairs, pip values, leverage, and market trends. I found resources like online courses, forex forums, and beginner-friendly blogs incredibly helpful in building this foundational knowledge.

- Exploring Trading Platforms: My next step was hands-on experimentation with trading platforms like MetaTrader 4 and 5. These platforms provide the environment for deploying and testing EAs. Setting up demo accounts allowed me to simulate trades without the risk of financial loss, giving me the freedom to experiment.

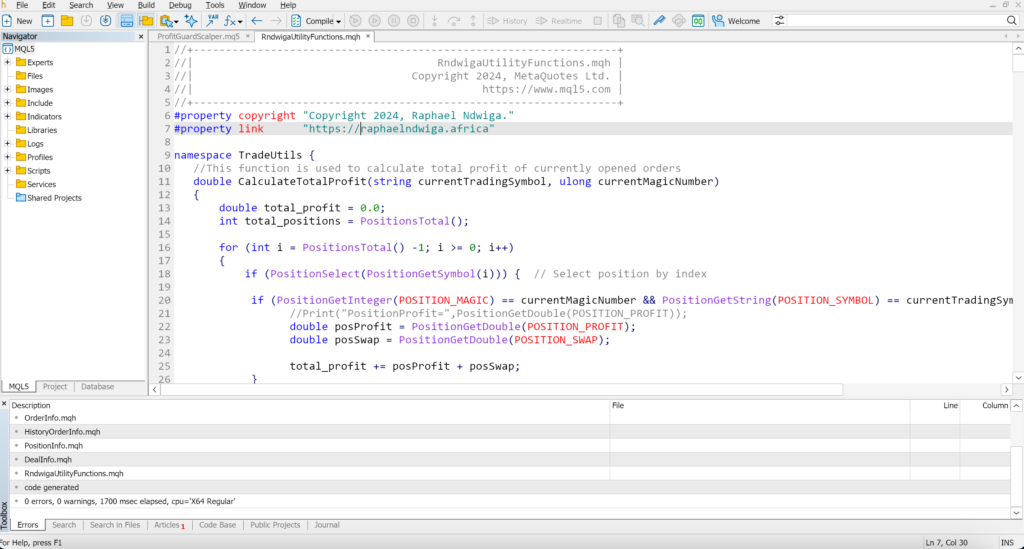

- Learning MQL4/MQL5: Transitioning from traditional programming languages to MQL4/MQL5 required some adjustment. To ease the learning curve, I referred to MetaTrader’s official documentation and supplemented it with tutorials on YouTube and coding communities. Starting with simple scripts, such as automating stop-loss orders, helped me grasp the language’s unique features.

- Experimenting with Simple Strategies: I started small by automating straightforward trading rules, like buying when prices cross a moving average. These initial strategies weren’t perfect, but they taught me the importance of precision and adaptability in trading logic.

- Backtesting Strategies: This step has been a game-changer. Using historical market data, I tested my EAs to evaluate their performance over time. Backtesting revealed flaws in my algorithms and provided insights into how market conditions affect trading outcomes. Iterating on these tests has been instrumental in refining my approach.

- Joining Communities: Engaging with forex and EA development communities has been invaluable. Platforms like MQL5.com, Reddit’s trading forums, and Discord groups are rich with insights, shared experiences, and solutions to common challenges.

- Tracking Progress: I’ve started journaling my experiments, strategies, and learnings. This practice helps me reflect on what works and doesn’t, ensuring continuous improvement.

Each of these steps has deepened my understanding of the technical and strategic aspects of EA development. While the learning curve is steep, the progress has been incredibly motivating.

Opportunities and Obstacles

EA development is a field brimming with potential, but it’s not without its hurdles:

The Opportunities

- Passive Income: Build bots that trade autonomously, creating financial opportunities around the clock.

- Intellectual Fulfillment: Designing strategies that perform in real-world markets is a rewarding challenge.

- Skill Diversification: Adding financial automation to your toolkit opens doors in fintech and beyond.

The Challenges

- Steep Learning Curve: Forex markets demand a blend of technical and financial knowledge.

- Market Volatility: Algorithms must adapt to rapid, often unpredictable changes.

- Continuous Iteration: Strategies that work today might fail tomorrow; adaptation is key.

The Impact of Expert Advisors

Expert Advisors (EAs) are transformative tools in the financial world, offering profound impacts on traders and market dynamics alike:

- Efficiency in Execution: EAs eliminate delays in trading decisions, ensuring trades are executed optimally. This speed can distinguish between a profit and a loss in fast-moving markets.

- Reduced Emotional Bias: By automating decisions, EAs remove human emotions like fear and greed from trading, fostering consistent and rational approaches to the market.

- Accessibility: Even novice traders can leverage sophisticated strategies by deploying pre-built EAs, democratizing access to advanced trading methods.

- Risk Mitigation: EAs can integrate automated risk management measures, such as stop-losses and position-sizing rules, to minimize losses and protect capital.

- Scalability: Unlike manual trading, EAs can simultaneously monitor and trade across multiple currency pairs or markets, expanding opportunities without added workload.

The impact of EAs extends beyond individual traders. By enhancing efficiency, consistency, and accessibility, these tools contribute to more liquid and dynamic markets, shaping how forex trading evolves. Their beauty lies in their adaptability. They can be as simple or complex as the problems they’re designed to solve.

Reflecting on the Learning Experience

This initial foray into EA development has been nothing short of transformative. While I’m still learning, it’s not just about writing code but crafting systems that navigate complexity with elegance. For me, this journey represents more than skill acquisition; it demonstrates the power of curiosity and adaptability.

If you’re a software engineer looking for a new challenge or someone intrigued by the fusion of technology and finance, EA development is worth exploring. It’s a field where precision meets possibility; the only limit is your willingness to innovate.

Ready to Take the Leap?

If this resonates with you, why not start your journey into EA programming? Experiment with platforms like MetaTrader, dive into MQL4/MQL5 and let your code become the backbone of financial strategies.

Do you have questions or need a nudge in the right direction? I’d love to hear from you. Let’s explore this exciting frontier together. As always, Stay curious, stay lazy (in the right way), and keep coding.

Mastering MQL5: Sharing the Journey and Building a Learning Path for All - Raphael Ndwiga December 25, 2024

[…] Two months into my MQL5 journey, I find myself not just reflecting on what I’ve learned but also thinking about how this knowledge can be shared. From struggling with syntax to deploying trading bots, the road has been one of discovery, challenges, and growth. But what excites me most now is the opportunity to bring others along for the ride. […]